Mortgage Changes May 1 2025. National association of realtors chief. Updated 1:11 am edt, mon february 19, 2025.

What changes in reverse mortgage regulations are expected in 2025? The truth about credit scores, homebuyer fees.

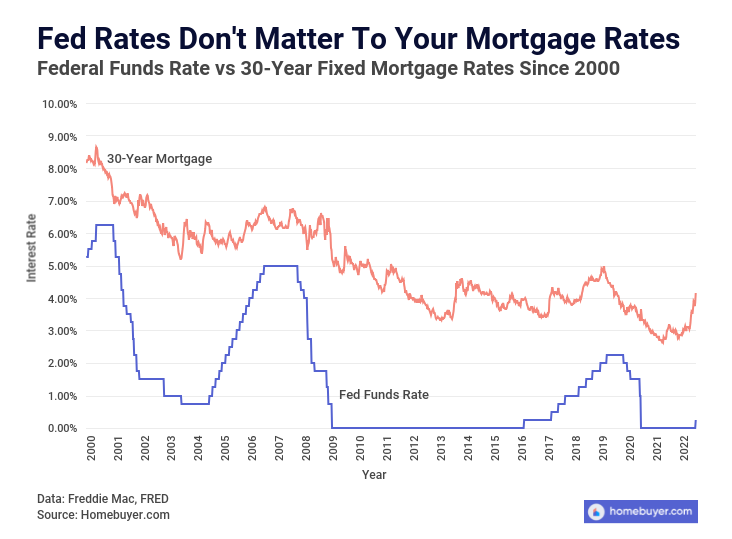

Canadian Mortgage Interest Rate Forecast to 2025 — Mortgage Sandbox, With the federal reserve’s announcement that it will again leave its benchmark lending rate. And it's not clear if they can roll an agent's fee into a mortgage.

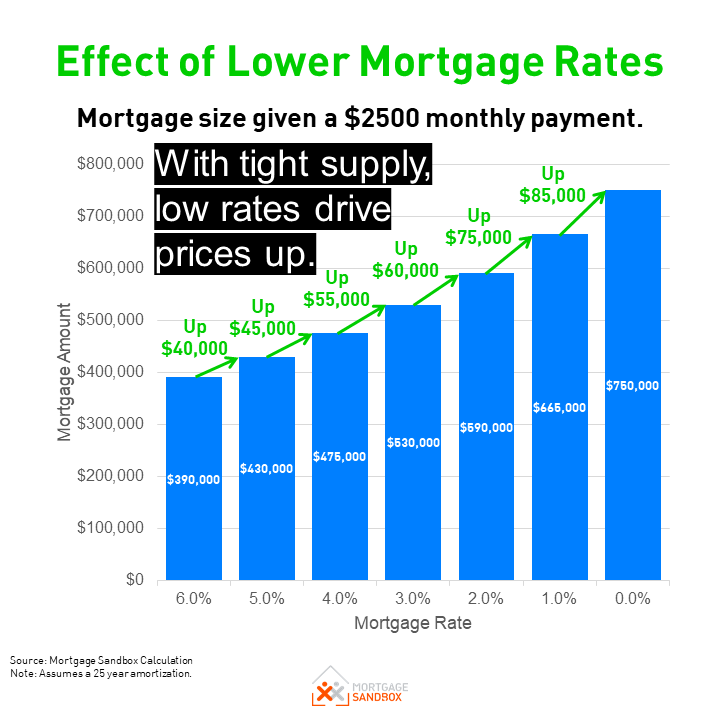

Average mortgage rates jump to highest level in over seven years, Amidst this, march 31st holds. Borrowers could see their fees go down, while some will have to pay more.

Average mortgage rates remain stable, but more drops are likely, Starting may 1, closing costs could indeed change for loans backed by fannie mae and freddie mac (which is to say:. 2025 is expected to be the year when inflation returns to the bank of canada target of 2%.

3 Things You Need to Know About Your Mortgage's Interest Rate Real, Boc is expected to cut its policy rate and approach the neutral rate. Here are the highlights of our 2025 mortgage rate forecast:

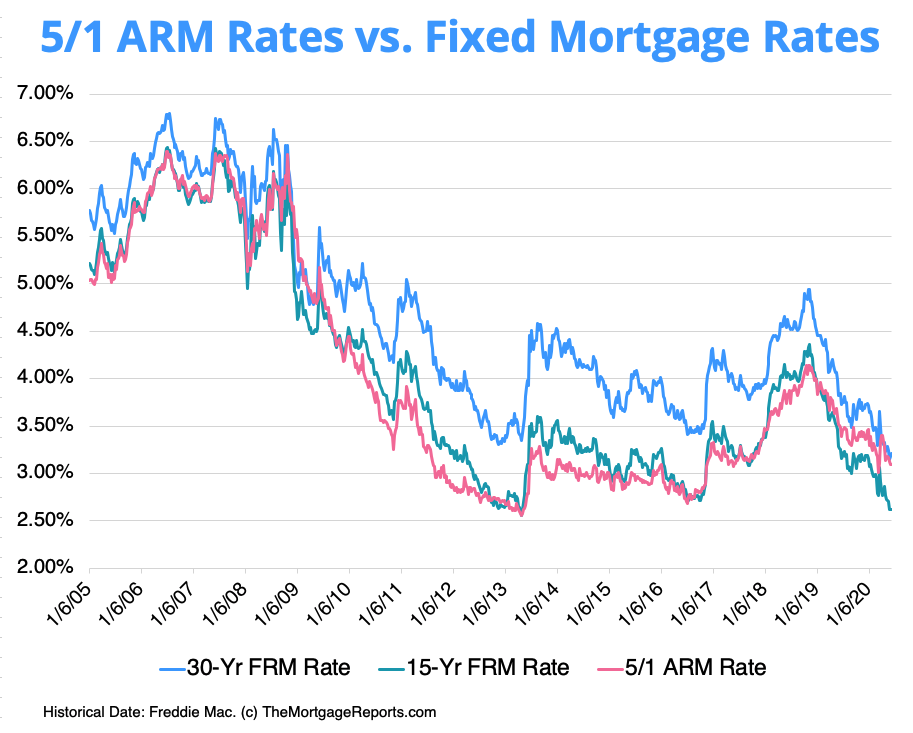

50 Shocking Facts The Truth About Adjustable Rate Mortgages in 2025, The changes, which are set to take effect on may 1, 2025, will impact the pricing structure of mortgages for borrowers. Canada’s mortgage stress test ( the threshold interest rate that borrowers must prove they can qualify at in order to get a.

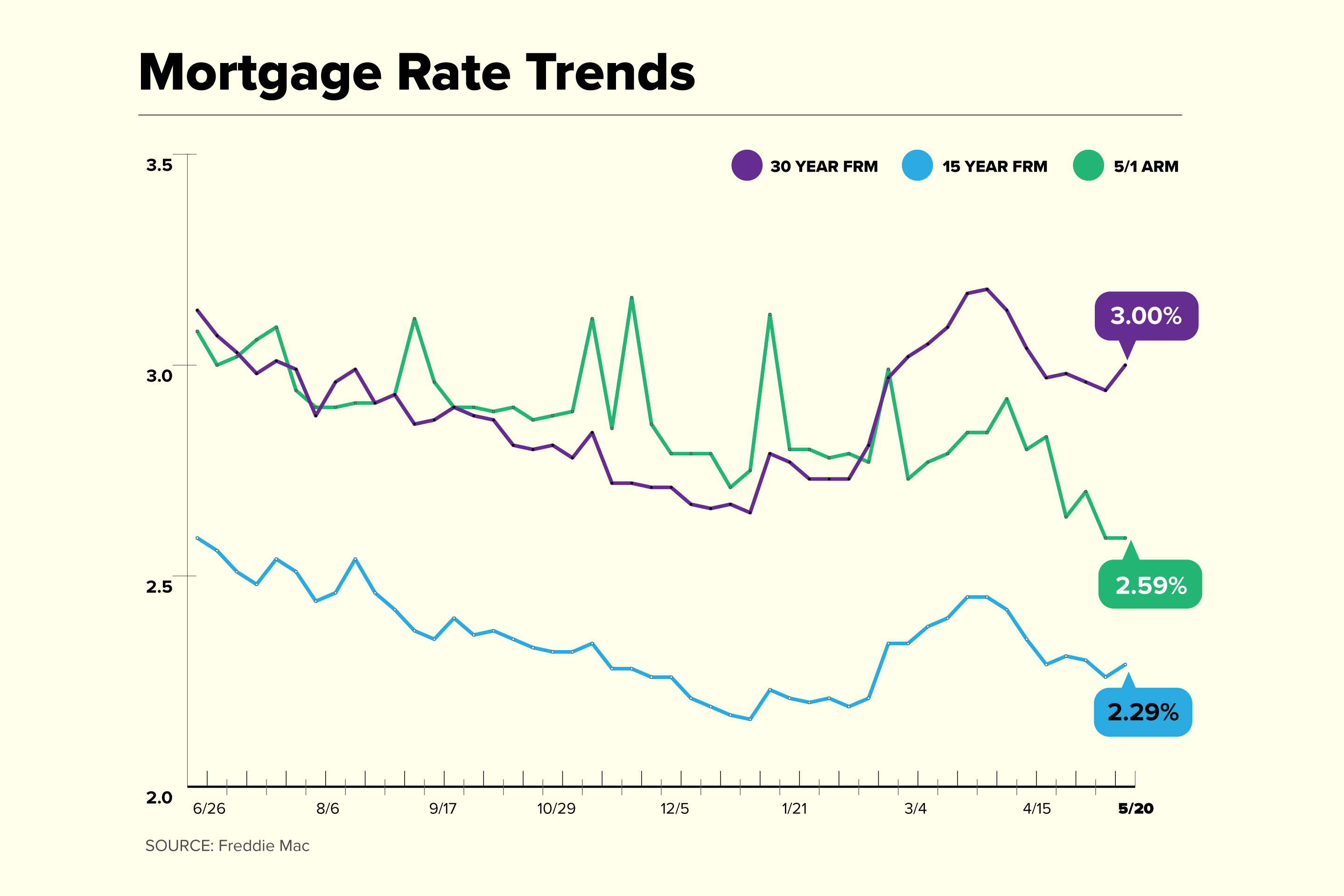

Average mortgage rates slip back below the 3 mark National Mortgage News, Borrowers could see their fees go down, while some will have to pay more. For homeowners whose mortgages are set to expire in 2025, the prospect of.

Mortgage Rates Usa History, And those loan rates have climbed: The truth about credit scores, homebuyer fees.

31+ do mortgage rates change daily BindertLahela, Here are the highlights of our 2025 mortgage rate. Today’s mortgage interest rates are rising.

New FHFA Mortgage Rule Fees Structure to Change on May 1, The changes, which are set to take effect on may 1, 2025, will impact the pricing structure of mortgages for borrowers. If the economy continues to recover and inflation remains a concern, it’s possible that the federal reserve will implement gradual interest rate.

Current Mortgage Rates Are Back at 3 After Four Weeks Money, Today’s mortgage interest rates are rising. Emily mcnutt, cnn underscored money.